As of January 1, 2022, the hazardous waste Generator Fee has been repealed and replaced with a new Generation and Handling (GH) fee (Senate Bill 158; Stats. 2021, ch.73). Prior to January 1, 2022, the hazardous waste generator fee was imposed on a tiered category basis. The State sent out Special notices in December 2021 Hazardous Waste Generation and Handling Fee – Application of Fee, Payments, and New Rate Effective January 1, 2022

Effective January 1, 2022, the hazardous waste generation and handling fee is imposed as a flat rate per ton or fraction of a ton on generators of hazardous waste for each generator site that generates five or more tons of hazardous waste at a site in California within a calendar year.

The hazardous waste generation and handling fee is calculated based on the total weight (measured in tons) of hazardous waste generated (produced or caused to be managed) from each site per year. The hazardous waste generation and handling fee is generally due regardless of the waste’s final disposition. Weight tickets should be maintained by the dealership to support the actual weight/quantity being reported. For more information, please visit the Department of Toxic Substances Control’s (DTSC) Manifest webpage, Fee Summary webpage, and Hazardous Substances (Waste) Fee Guide (ca.gov). State of California has posted guidance on this law on the https://dtsc.ca.gov/generator-fee/ (DTSC) website.

State sent a Special notice on Filing requirements in August 2022. L-863, Hazardous Waste Generation and Handling Fee Program Reminders and Online Filing Requirement (ca.gov).

Hazardous wastes that are typically generated at an automobile dealership and subject to this fee are:

· Recycled hazardous waste

· Non-manifested universal waste

· Waste sent outside California for disposal

· Used motor oil (Except used oil collected from the public. See note below)

· Waste coolant (CA code 134),

· Oily water (CA Code 223), and

· Waste paper filters (CA code 352 or 223)

If you are punching or crushing metal oil filters, under DTSC guidelines, you can dispose of them as scrap metal (through your hazardous waste hauler) and hence not be subject to this fee. If you decide to dispose of used metal oil filters as hazardous waste, those metal filters get added to your hazardous waste tonnage calculations.

HOW THE FEE IS CALCULATED

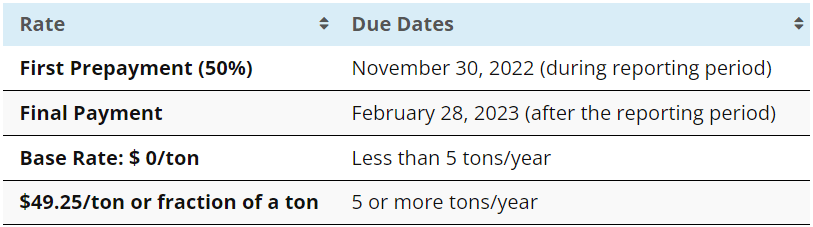

Beginning January 1, 2022, all GH fee accounts are required to make one prepayment which is due and payable on or before November 30th each year.

- Prepayment – Due on November 30th of each year.

- Final Payment with Return – Due on February 28th of each year.

Your prepayment must be equal to 50 percent of the total amount due for the hazardous waste generation and handling fee for the entire prior calendar year. Keep proper records to support tonnage of hazardous waste generated and handled at each site.

| Reporting Period | Prepayment Due Date | Return & Final Payment Due Date | Report Based on Hazardous Waste Generated in Prior Reporting Period |

| Calendar Year 2022 | November 30, 2022 | February 28, 2023 | Calendar Year 2021 |

| Calendar Year 2023 | November 30, 2023 | February 28, 2024 | Calendar Year 2022 |

| Calendar Year 2024 | November 30, 2024 | February 28, 2025 | Calendar Year 2023 |

Returns

The hazardous waste GH fee return and payment are due by February 28 each year. (RTC 43152.7) The fee is calculated based on waste generated in the prior calendar year. (HSC 25205.5)

File a Return Online – You are required to file your GH fee return electronically through California Department of Tax and Fee Administration (CDTFA) online services homepage.

Every generator that produces five tons or more of hazardous waste will pay CDTFA a GH Fee for each generator site for each calendar year, or portion thereof. Hazardous Waste facilities permitted under a full or standardized permit that pay annual Generators are required to report the amount of waste generated on a hazardous waste Generation and Handling Fee return provided by CDTFA. The rates specified in table below are for Fiscal Year 2022/23 for hazardous waste generated in Calendar Year 2021:

Note 1: Commencing on July 1, 2023, the Board of Environmental Safety will reset (increase) the annual GH Fee to correspond to the annual appropriation amount for Fiscal Year 2023/24, per Health &Safety Code section 25205.5.01. Beginning with FY 2024/25, the Board shall adjust the GH Fee for changes to the Consumer Price Index (CPI).

Note 2: Please contact your waste hauler(s) for technical guidance on conversion of gallons of waste to tons.

For example, 1 gallon of used oil is approximately 7.4 pounds. 10,000 gallons is 74,000 pounds. 2,000 pounds equals one ton.

74,000/2,000 = 37 tons. In summary, 10,000 gallons of used motor oil weighs approximately 37 tons!

Note 3: GH Fees do not apply to used oil collected from the public by certified used oil collection centers.

Don’t know your tonnage?

Please contact your dedicated waste hauler(s) to determine total tonnage. Once determined, please register online with CDTFA and complete the fee process. Maintain support documentation of fee completion for your records. Finally, we note that this is a tax/fee matter and you must consult your tax consultant on calculations and record retention requirements.

Contacts at CDTFA: Thomas, Cathie Cathie.Thomas@cdtfa.ca.gov, Kevin McCarley Kevin.McCarley@cdtfa.ca.gov, Yatoba Godina Yatoba.Godina@cdtfa.ca.gov or 800-400-7115.

DISCLAIMER: The contents of this newsletter are for informational purposes only and are not to be considered legal advice. Employers must consult their lawyer for legal matters and EPA/OSHA consultants for matters related to Environmental, Health & Safety. The article was authored by Sam Celly of Celly Services, Inc. who has been helping automobile dealers in Arizona, California, Hawaii, Idaho, Nevada, New Mexico, New York, Texas, and Virginia comply with EPA and OSHA regulations for over 35 years. Sam is a Certified Safety Professional (No. 16515) certified by the National Board of Certified Safety Professionals. Sam received his BE (1984) and MS (1986) in Chemical Engineering, followed by a J.D. from Southwestern University School of Law (1997). Sam is a member of the American Chemical Society (No. 31176063), American Industrial Hygiene Association (No. 124715), and National Association of Dealer Counsel (NADC). Sam also serves on the Board of Orange County American Industrial Hygiene Association and on CA Industrial Hygiene Council (CIHC). Our newsletters can be accessed at www.epaoshablog.com. We welcome your comments/questions. Please send them to sam@cellyservices.com.